by Charles Hugh Smith

Source: Of Two Minds

The Fed policy’s first-order effect is to issue hundreds of billions in “free money” to banks; the second-order effect is to destroy the rule of law in the U.S.

Let’s start with a few questions about the proper role of the Central State and Central Bank: why should they bail out private banks? The answer boils down to something like this: “If the private banks absorbed the losses that are rightly theirs in a capitalist system, they would implode. Since the State and Central Bank have enabled these private banks to infiltrate and dominate the nation’s financial system, that system is now hostage to these private ‘too big to fail’ banks.”

In other words, “capitalism” in America now means socializing losses and privatizing profits generated by State and Central Bank intervention. Imagine for a moment the “beauty” of this system for owners of private banks: in a truly socialized banking system, the taxpayers would absorb any losses, but the State would also benefit from any future bank-sector profits. In the U.S. system, the losses are socialized but the people draw no benefit; the profits flow to the top 1/10th of 1% private financiers.

This is the perfection of State-financier crony capitalism.

Let’s next ask why the Central State and Central Bank should subsidize and bail out the mortgage industry, a major component of private banking. Once again we find losses are neatly distributed to the citizenry while the profits all flow to private hands. Given that 98% of all mortgages are backed or guaranteed by Federal agencies (Fannie Mae, Freddie Mac, Ginnie Mae, FHA, VA, FmHA, etc.), the mortgage market is already completely socialized: the taxpayers are on the hook for any and all losses, but the profits from originating and servicing the loans are all private.

Meanwhile, 1 out of 6 FHA insured loans are delinquent, and everyone who cares to examine the ledger knows the taxpayers will soon be bailing out FHA just as they did Fannie Mae and Freddie Mac.

But the socialization of losses and privatizing of profits is only the first-order effect of the banks’ capture of the State. The second-order effect is even more destructive: the rule of law has been subverted by the world’s largest money-laundering machine, the Federal Reserve.

Once again we can start by asking why a nation’s Central Bank should buy mortgages from private financial institutions. Once again the first answer is a variation on the same theme: the Central Bank prints money and buys the mortgages as a way of socializing private losses and passing through billions of dollars in “free money” to private hands.

The newly printed money robs purchasing power from every holder of the currency (the socialization of costs) while the immense flood of “free money” flows to private hands.

Here’s how it works. We know Fannie Mae is absorbing losses of 50% to 65% on its foreclosed properties (Nearly half of Fannie Mae REO unable to reach market, via U. Doran), and we also know that 31% of all homeowners with mortgages are “underwater,” owing more than their house is worth (Housing, Diminishing Returns and Opportunity Cost).

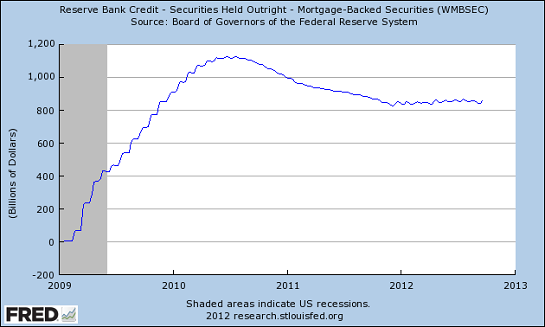

We also know the Federal Reserve bought $1.1 trillion in MBS (mortgage-backed securities) in 2009-10, and the Fed has announced its intention to buy $40 billion more MBS a month until the housing bubble re-inflates or Doomsday, whichever comes first.

The Fed also bought $1 trillion in Treasury bonds, monetizing Federal debt:

Let’s say you own a portfolio of mortgage-backed securities and your pals at the Fed are willing to buy the garbage at full price, no questions asked: are you going to sell your few AAA-rated MBS, the good stuff, or are you going to sell them the absolute dregs, the MBS so stuffed with defaulted mortgages that you’ve never dared to even do a mark-to-market estimate of their real worth?

You dump the worst of your portfolio, naturally, and so in effect the $1.1 trillion in MBS the Fed bought with newly created cash was probably worth (charitably) $600 billion at best. That means the Fed not only wiped out the losses that should have accrued to the owners of the impaired mortgages by removing the MBS from their books, it handed the owners (banks, pension funds, etc.) a cool $500 billion in “free money” by paying full value for massively impaired assets.